What if I invest at the high point?

Ben Carlson gives a thought experiment on Bob, the world’s unluckiest investor.

- If you are going to make investment mistakes, make sure you are biased towards optimism and not pessimism. Long-term thinking has been rewarded in the past and unless you think the world or innovation is coming to an end it should be rewarded in the future. As Winston Churchill once said, “I am an optimist. It does not seem too much use being anything else.”

- Losses are part of the deal when investing in stocks. How you react to those losses is one of the biggest determinants of your investment performance.

- Saving more, thinking long-term and allowing compound interest to work in your favor are your biggest accelerants for building wealth. These factors have nothing to do with picking stocks or a complex investment strategy. Get these big things right and any disciplined investment strategy should do the trick.

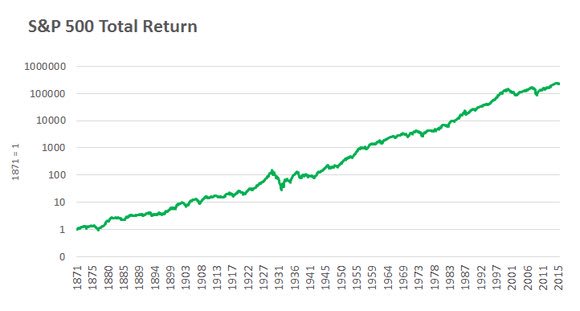

As Ben shows, even investing at the worst possible time over the last few decades would still earn money over the long run. Any buy-and-hold in a broadly-diversified portfolio is historically guaranteed to end up with gains, as long as you can just shut up and wait.

Remember to shut up and wait, and let the markets do their thing.